Homeowner Scams Overview

With real estate increasingly valuable in New York, many scam artists are preying on the misfortunes of homeowners who are struggling to make payments on their mortgages. The best antidote is to learn how to spot scams, and to avoid them altogether.

What does a homeowner scam look like?

How can I prevent homeowner scams and frauds?

What does a homeowner scam look like?

Scammers are innovating frequently to stay ahead of law enforcement, regulations, and advocates. Some common types of scams we’ve seen in the past few years include:

Foreclosure rescue and refinance scams: Scam artists offer to negotiate with a homeowner’s lender on their behalf to obtain a new loan repayment plan or mortgage modification, often guaranteeing they can save a home from foreclosure. They may ask a homeowner to pay mortgage payments directly to them instead of a servicer. Those scammers typically pocket a homeowner’s money, putting them further behind on their mortgage.

Scam lawsuit: Scammers offer to bring a lawsuit on behalf of homeowners, promising they can get a modification or obtain a settlement from the homeowner’s bank. These lawsuits have no chance of success, but rather are used to charge homeowners a fee that the scammer can then pocket.

Debt-elimination scams: Scammers may try to convince homeowners that their mortgage or debt is illegitimate and that they do not have to pay it back. Scammers may make reference to inaccurate or “little known” laws or financial regulations to justify their services. However, the scammer often pockets any fees for her or himself.

Forensic audit scams: Scammers offer “auditors” or an attorney to examine a homeowner’s mortgage document to determine if the lender complied with the law, offering a report that they claim can help avoid foreclosure, obtain a modification, or even cancel a loan. They typically charge an up-front fee for this service without delivering results.

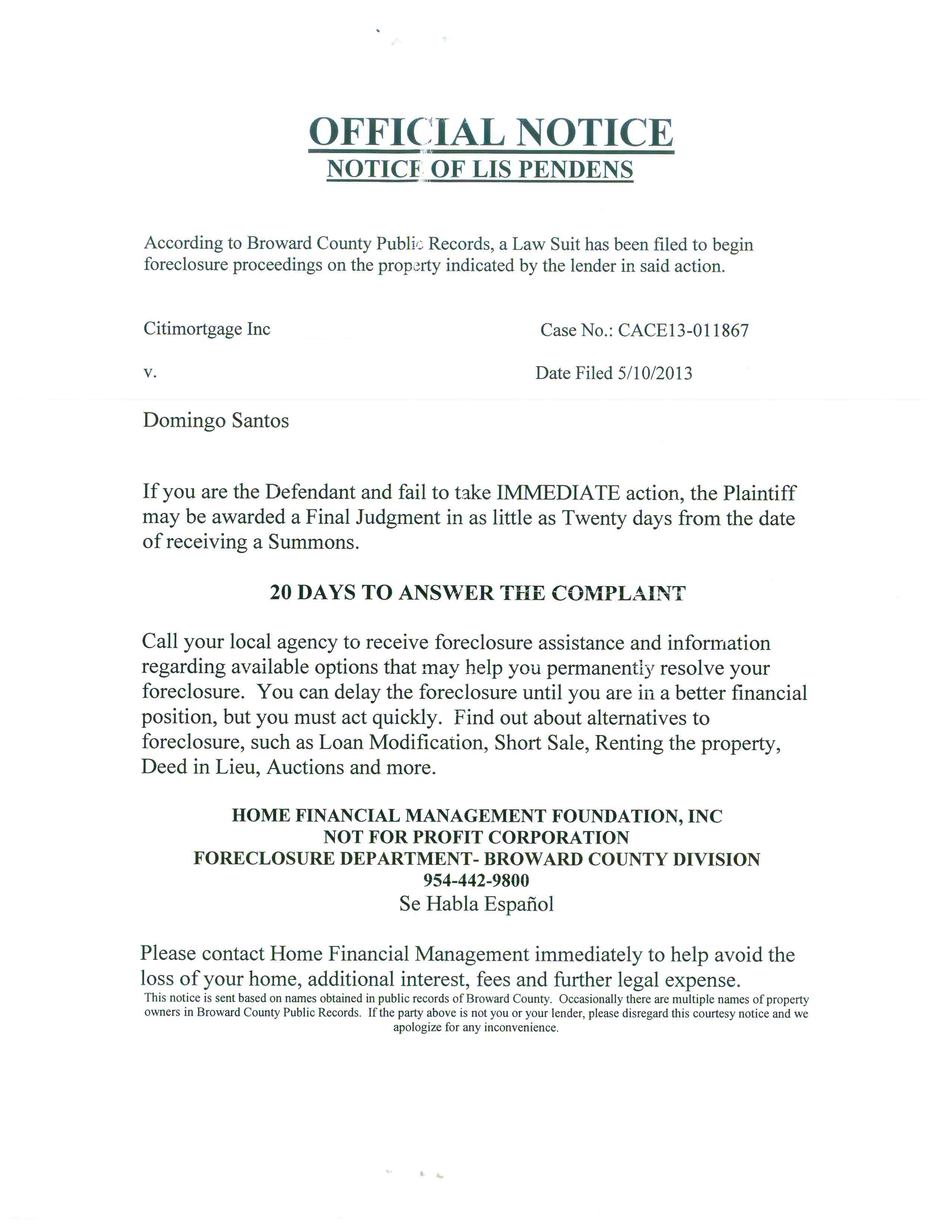

Fake government and bank modification programs: Scam artists create websites, brochures, or commercials that mimic legitimate programs and organizations. They are designed to make homeowners believe they are dealing with a legitimate program or their bank.

Bankruptcy scams: Scam artists may claim that bankruptcy will prevent a home from going into foreclosure. While bankruptcy proceedings can delay a foreclosure slightly, they won’t change the amount owed on a home and will hurt a homeowner’s credit score.

Leaseback and rent-to-buy scams: Scammers explain that a homeowner can get new and better financing if they sign over the title or deed, promising that the homeowner will be able to buy back the home. These agreements are often written so that it is hard for the homeowner to comply with the terms.

Deed fraud: Fraudsters will transfer the deed to a home, sometimes unbeknownst to the homeowner, to themselves or to a third party.

Partition scam: Scammers persuade one heir to sell their property rights to a home. Although that heir is often unaware, their decision usually forces the sale of the home at a significantly lower price than if it had been sold on the market.

Home improvement scam: Homeowners looking for a help with for a large home repair are usually prime targets. Calling themselves a contractor, the scam artist convinces the homeowner to contract with them for both the work and financing. Once the overpriced, rushed repairs are done, the scammer sells the loan to a predatory lender. By the time the homeowner catches on, the scammer is gone and they’re stuck with the debt and the shoddy work.

Bait and switch scam: Scammers advertise a loan with extremely good terms. When the homeowner is close to signing, the scammer tells them that the loan is no longer available and offers another loan with less favorable terms.

The Center for NYC Neighborhoods and our government partners are always on the lookout for new scams and frauds to keep homeowners informed. You can keep up with new updates by following the Center on social media and by checking back on this page for updates.

How can I prevent homeowner scams and frauds?

While scammers are often clever, you can protect yourself by taking some extra precautions:

Beware of guarantees or promises. Be wary of trusting a company or individual that “guarantees” or “promises” that you will receive a loan modification or any other outcome with your mortgage. Legitimate organizations and individuals can only promise to work hard for you. They cannot guarantee results.

Avoid paying upfront fees. It’s almost always illegal to ask for upfront fees for a loan modification. Be wary if you’re asked to pay for services up front.

Don’t stop your mortgage payments. Watch out if you are asked to stop making your regular mortgage payments and to pay the assistance company instead. Never send your mortgage payment to anyone other than your mortgage lender or servicer. If someone who claims to be your lender or servicer asks you to change where you are sending your mortgage payments, stop. Call the organization directly and confirm that the change is legitimate.

Confused by the paperwork? Be wary of anyone who pressures you to sign any paperwork that you do not understand. If you have questions about a document, ask. A trustworthy individual or organization should make sure you understand what you are signing before you do.

Never transfer ownership of your property. Never turn over your deed or transfer ownership of your home to a mortgage assistance company. A trustworthy organization or individual will not ask you to transfer your property rights to them.

Avoid aggressive sales pitches. Beware of companies that call you, and suggest that without their assistance you will lose your home; likewise, be wary of anyone who presents you with limited-time offers. Legitimate organizations should not aggressively pursue you as a client.

Don’t automatically trust titles and uniforms. Scam artists can pose as government employees, law enforcement officials, bank employees, and more. If you’re not sure if you can trust someone, you can always call the bank or government organization to confirm if the person works for them. Be wary about the information you are providing to anyone; for example, government employees should never ask for your bank account number.

Have someone you trust look after your home. If you will be away from your home for a long period of time, get a trusted friend or neighbor to make sure mail isn’t piling up and the home isn’t being occupied illegally.

Register for notification of legal changes to your property. New York City residents can opt into the Recorded Document Notification Program to receive alerts to any legal changes like ownership of their property.

Get a bad feeling? Does something seem unusual? Unsure if the person you’re working with is legitimate? You can contact the Attorney General’s Homeowner Protection Program (HOPP) hotline at 855-HOME-456 (855-464-3456) for free, quality assistance.

How can I avoid scams in the homebuying process?

Homebuyers are also at risk of potential mortgage scams and frauds. You can read a bit more about them here. If you are new to the homebuying process, we recommend working with a pre-purchase counselor who can help you understand the ins and outs of homebuying. You can find a pre-purchase counselor near you by contacting the Attorney General’s Homeowner Protection Program (HOPP) hotline at 855-HOME-456 (855-464-3456).

When is it too late to report a scam or fraud?

It is never too late to report a homeowner scam or fraud. If you’re not getting the help you need or are unsure about whether you can trust a company or individual to help you with your home or mortgage, call the Attorney General’s Homeowner Protection Program (HOPP) hotline at 855-HOME-456 (855-464-3456). The hotline can refer you to one of its network of over 85 housing counseling and legal services organizations across the state that provide free help to homeowners at risk of foreclosure. Hotline representatives can connect you to high-quality counseling or legal services all over New York State. All services are provided free of charge.

You can also visit the U.S. Department of Housing and Urban Development’s website for a list of approved housing counseling agencies that may be able to provide you with free assistance throughout the country.

For information and resources on deed theft, please go here.